| Star | Watch | Fork |

| Home |

|---|

| User Guide |

| Examples |

| About |

Adaptive Robust Lot-Sizing

In this example, we consider a lot-sizing problem described in Bertsimas and de Ruiter (2016). In a network with \(N\) stores, the stock allocation \(x_i\) for each store \(i\) is determined prior to knowing the realization of the demand at each location. The demand, denoted by the vector \(d\), is uncertain and assumed to be in a budget uncertainty set

\[\mathcal{U}=\left\{\pmb{d}: \pmb{0}\leq \pmb{d} \leq d_{\text{max}}\pmb{e}, \pmb{e}^{\top}\pmb{d} \leq \Gamma\right\}.\]After the demand realization of demand is observed, stock \(y_{ij}\) could be transported from store \(i\) to store \(j\) at a cost of \(t_{ij}\), in order to meet all demand. The objective is to minimize the worst-case total cost, expressed as the storage cost (with unit cost \(c_i\) for each store \(i\)) and cost of shifting products from one store to another. Such an adaptive model can be written as

\[\begin{align} \min~&\max\limits_{\pmb{d}\in\mathcal{U}} \sum\limits_{i=1}^Nc_ix_i + \sum\limits_{i=1}^N\sum\limits_{j=1}^Nt_{ij}y_{ij} && &\\ \text{s.t.}~&d_i \leq \sum\limits_{j=1}^Ny_{ji} - \sum\limits_{j=1}^Ny_{ij} + x_i, &&i=1, 2, ..., N, & \forall \pmb{d} \in \mathcal{U} \\ &0\leq x_i\leq K_i, &&i = 1, 2, ..., N & \end{align}\]with \(K_i\) to be the stock capacity at each location, and the adaptive decision \(y_{ij}\) to be approximated by

\[y_{ij}(\pmb{d}) = y_{ij}^0 + \sum\limits_{k=1}^Ny_{ijk}^dd_k,\]or in other words, the linear decision rule for each wait-and-see decision \(y_{ij}\) is \(\mathcal{L}([N])\). For a test case, we pick \(N=30\) locations uniformly at random from \([0, 10]^2\). The shifting cost \(t_{ij}\) is calculated as the Euclidean distance between the stores \(i\) and \(j\), and the storage cost \(c_i\) is assumed to be 20. The maximum demand \(d_{\text{max}}\) and the stock capacity \(K_i\) are both set to be 20 units, and the parameter \(\Gamma\) in the uncertainty set is set to \(20\sqrt{N}\). Such an adaptive model can be implemented by the following Python code using RSOME.

from rsome import ro

import rsome.grb_solver as grb

import numpy as np

import numpy.random as rd

import matplotlib.pyplot as plt

# Parameters of the lot-sizing problem

N = 30

c = 20

dmax = 20

Gamma = 20*np.sqrt(N)

xy = 10*rd.rand(2, N)

t = ((xy[[0]] - xy[[0]].T) ** 2

+ (xy[[1]] - xy[[1]].T) ** 2) ** 0.5

model = ro.Model() # define a model

x = model.dvar(N) # define location decisions

y = model.ldr((N, N)) # define decision rule as the shifted quantities

d = model.rvar(N) # define random variables as the demand

y.adapt(d) # the decision rule y affinely depends on d

uset = (d >= 0,

d <= dmax,

sum(d) <= Gamma) # define the uncertainty set

# define model objective and constraints

model.minmax((c*x).sum() + (t*y).sum(), uset)

model.st(d <= y.sum(axis=0) - y.sum(axis=1) + x)

model.st(y >= 0)

model.st(x >= 0)

model.st(x <= 20)

model.solve(grb)

Being solved by Gurobi...

Solution status: 2

Running time: 2.8133s

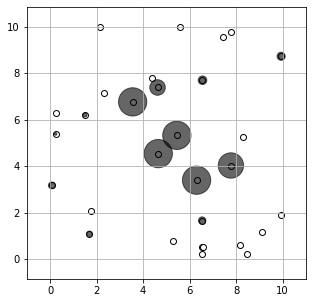

The solution is displayed by the following figure, with the bubble size indicating the stock allocations at each location.

plt.figure(figsize=(5, 5))

plt.scatter(xy[0], xy[1], c='w', edgecolors='k')

plt.scatter(xy[0], xy[1], s=40*x.get(), c='k', alpha=0.6)

plt.axis('equal')

plt.xlim([-1, 11])

plt.ylim([-1, 11])

plt.grid()

plt.show()

Reference

Bertsimas, Dimitris, and Frans JCT de Ruiter. 2016. Duality in two-stage adaptive linear optimization: Faster computation and stronger bounds. INFORMS Journal on Computing 28(3) 500-511.