| Star | Watch | Fork |

| Home |

|---|

| User Guide |

| Examples |

| About |

Conditional Value-at-Risk in Robust Portfolio

This robust portfolio management model is proposed by Zhu and Fukushima (2009). The portfolio allocation is determined via minimizing the worst-case conditional value-at-risk (CVaR) under ambiguous distribution information. The generic formulation is given as

\[\begin{align} \min~&\max\limits_{\pmb{\pi}\in \Pi} \alpha + \frac{1}{1-\beta}\pmb{\pi}^{\top}\pmb{u} &\\ \text{s.t.}~& u_k \geq -\pmb{y}_k^{\top}\pmb{x} - \alpha, &\forall k = 1, 2, ..., s \\ &u_k \geq 0, &\forall k=1, 2, ..., s \\ &\sum\limits_{k=1}^s\pi_k\pmb{y}_k^{\top}\pmb{x} \geq \mu, &\forall \pmb{\pi} \in \Pi \\ &\underline{\pmb{x}} \leq \pmb{x} \leq \overline{\pmb{x}} \\ &\pmb{1}^{\top}\pmb{x} = w_0 \end{align}\]with investment decisions \(\pmb{x}\in\mathbb{R}^n\) and auxiliary variables \(\pmb{u}\in\mathbb{R}^s\) and \(\alpha\in\mathbb{R}\), where \(n\) is the number of stocks, and \(s\) is the number of samples. The array \(\pmb{\pi}\) denotes the probabilities of samples, and \(\Pi\) is the uncertainty set that captures the distributional ambiguity of probabilities. The constant array \(\pmb{y}_k\in\mathbb{R}^n\) indicates the \(k\)th sample of stock return rates, and \(\bar{x}\) and \(\underline{x}\) are the lower and upper bounds of \(x\). The worst-case minimum expected overall return rate is set to be \(\mu=0.001\), the confidence level is \(\beta=0.95\), and the budget of investment is set to be \(w_0=1\). In this case study, we consider the sample data of eight stocks “JPM”, “AMZN”, “TSLA”, “AAPL”, “GOOG”, “ZM”, “META”, and “MCD”, in the year of 2021, and the other parameters are specified by the following code segment.

import pandas as pd

import yfinance as yf

stocks = ['JPM', 'AMZN', 'TSLA', 'AAPL', 'GOOG', 'ZM', 'META', 'MCD']

start = '2021-1-2' # starting date of historical data

end='2021-12-31' # end date of historical data

data = pd.DataFrame([])

for stock in stocks:

each = yf.Ticker(stock).history(start=start, end=end)

close = each['Close'].values

returns = (close[1:] - close[:-1]) / close[:-1]

data[stock] = returns

data

| JPM | AMZN | TSLA | AAPL | GOOG | ZM | META | MCD | |

|---|---|---|---|---|---|---|---|---|

| 0 | 0.005441 | 0.010004 | 0.007317 | 0.012364 | 0.007337 | 0.002361 | 0.007548 | 0.005994 |

| 1 | 0.046956 | -0.024897 | 0.028390 | -0.033662 | -0.003234 | -0.045506 | -0.028269 | -0.002270 |

| 2 | 0.032839 | 0.007577 | 0.079447 | 0.034123 | 0.029943 | -0.005546 | 0.020622 | 0.004645 |

| 3 | 0.001104 | 0.006496 | 0.078403 | 0.008631 | 0.011168 | 0.020759 | -0.004354 | 0.018351 |

| 4 | 0.014924 | -0.021519 | -0.078214 | -0.023249 | -0.022405 | -0.034038 | -0.040102 | -0.007597 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 245 | 0.003574 | 0.000184 | 0.057619 | 0.003644 | 0.001317 | -0.007663 | 0.014495 | 0.003812 |

| 246 | 0.005723 | -0.008178 | 0.025248 | 0.022975 | 0.006263 | -0.021967 | 0.032633 | 0.008610 |

| 247 | 0.003035 | 0.005844 | -0.005000 | -0.005767 | -0.010914 | -0.019580 | 0.000116 | -0.001342 |

| 248 | -0.000504 | -0.008555 | -0.002095 | 0.000502 | 0.000386 | -0.010666 | -0.009474 | 0.002277 |

| 249 | -0.000505 | -0.003289 | -0.014592 | -0.006578 | -0.003427 | 0.047907 | 0.004141 | -0.004767 |

250 rows × 8 columns

import numpy as np

y = data.values # stock data as an array

s, n = y.shape # s: sample size; n: number of stocks

x_lb = np.zeros(n) # lower bounds of investment decisions

x_ub = np.ones(n) # upper bounds of investment decisions

beta =0.95 # confidence interval

w0 = 1 # investment budget

mu = 0.001 # target minimum expected return rate

Nominal CVaR model

In the nominal model, the CVaR and expected returns are evaluated assuming the exact distribution of stock returns is accurately represented by the historical samples without any distributional ambiguity. In other words, \(\Pi\) is written as a singleton uncertainty \(\Pi = \{\pmb{\pi}^0 \}\), where \(\pi_k^0=1/s\), with \(k=1, 2, …, s\). The Python code for implementing the nominal model is given below.

from rsome import ro

from rsome import msk_solver as msk

model = ro.Model()

pi = np.ones(s) / s

x = model.dvar(n)

u = model.dvar(s)

alpha = model.dvar()

model.min(alpha + 1/(1-beta) * (pi@u))

model.st(u >= -y@x - alpha)

model.st(u >= 0)

model.st(pi@y@x >= mu)

model.st(x >= x_lb, x <= x_ub, x.sum() == w0)

model.solve(msk)

Being solved by Mosek...

Solution status: Optimal

Running time: 0.0208s

The portfolio decision for the nominal model is retrieved by the following code.

x_nom = x.get()

model.get()

0.018195323668177367

Worst-case CVaR model with box uncertainty

Now we consider a box uncertainty set

\[\Pi = \left\{\pmb{\pi}: \pmb{\pi} = \pmb{\pi}^0 + \pmb{\eta}, \pmb{1}^{\top}\pmb{\eta}=0, \underline{\pmb{\eta}}\leq \pmb{\eta} \leq \bar{\pmb{\eta}} \right\}.\]In this case study, we assume that \(-\underline{\pmb{\eta}}=\bar{\pmb{\eta}}=0.0001\), and the Python code for implementation is provided below.

from rsome import ro

from rsome import msk_solver as msk

model = ro.Model()

eta_ub = 0.0001 # upper bound of eta

eta_lb = -0.0001 # lower bound of eta

eta = model.rvar(s) # eta as random variables

uset = (eta.sum() == 0,

eta >= eta_lb,

eta <= eta_ub)

pi = 1/s + eta # pi as inexact probabilities

x = model.dvar(n)

u = model.dvar(s)

alpha = model.dvar()

model.minmax(alpha + 1/(1-beta) * (pi@u), uset)

model.st(u >= -y@x - alpha)

model.st(u >= 0)

model.st(pi@y@x >= mu)

model.st(x >= x_lb, x <= x_ub, x.sum() == w0)

model.solve(msk)

Being solved by Mosek...

Solution status: Optimal

Running time: 0.0208s

x_box = x.get()

model.get()

0.018541181700867923

Worst-case CVaR model with ellipsoidal uncertainty

In cases that \(\Pi\) is an ellipsoidal uncertainty set

\[\Pi = \left\{\pmb{\pi}: \pmb{\pi} = \pmb{\pi}^0 + \rho\pmb{\eta}, \pmb{1}^{\top}\pmb{\eta}=0, \pmb{\pi}^0 + \rho\pmb{\eta} \geq \pmb{0}, \|\pmb{\eta}\| \leq 1 \right\},\]where the nominal probability \(\pmb{\pi}^0\) is the center of the ellipsoid, and the constant \(\rho=0.001\), then the model can be implemented by the code below.

from rsome import ro

from rsome import msk_solver as msk

import rsome as rso

model = ro.Model()

rho = 0.001

eta = model.rvar(s)

uset = (eta.sum() == 0, 1/s + rho*eta >= 0,

rso.norm(eta) <= 1)

pi = 1/s + rho*eta

x = model.dvar(n)

u = model.dvar(s)

alpha = model.dvar()

model.minmax(alpha + 1/(1-beta) * (pi@u), uset)

model.st(u >= -y@x - alpha)

model.st(u >= 0)

model.st(pi@y@x >= mu)

model.st(x >= x_lb, x <= x_ub, x.sum() == w0)

model.solve(grb)

Being solved by Mosek...

Solution status: Optimal

Running time: 0.0284s

x_ellip = x.get()

model.get()

0.018270742978340224

Worst-case CVaR with KL divergence

Here, we consider the KL divergence-constrained ambiguity of probabilities

\[\Pi = \left\{\boldsymbol{\pi}: \boldsymbol{\pi} \geq 0, \boldsymbol{1}^{\top}\boldsymbol{\pi} = 1, \sum_{k=1}^s\pi_k\log(\pi_k/\hat{\pi}_k) \leq \epsilon \right\},\]where \(\hat{\pi}_k = 1/s\) is the empirical probability of each sample. Assume that the constant \(\epsilon=0.001\), the code for implementing such a robust model is given below.

from rsome import ro

from rsome import msk_solver as msk

import rsome as rso

model = ro.Model()

epsilon = 0.001

pi = model.rvar(s)

uset = (pi.sum() ==1, pi >= 0,

rso.kldiv(pi, 1/s, epsilon)) # uncertainty set of pi

x = model.dvar(n)

u = model.dvar(s)

alpha = model.dvar()

model.minmax(alpha + 1/(1-beta) * (pi@u), uset)

model.st(u >= -y@x - alpha)

model.st(u >= 0)

model.st(pi@y@x >= mu)

model.st(x >= x_lb, x <= x_ub, x.sum() == w0)

model.solve(msk)

Being solved by Mosek...

Solution status: Optimal

Running time: 0.0936s

x_kld = x.get()

model.get()

0.02128303758055805

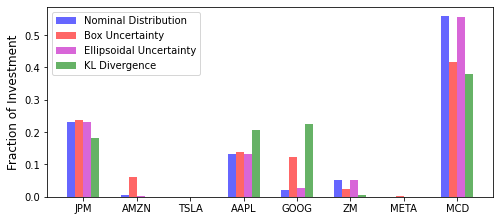

Visualization of portfolio decisions

Decisions in terms of the allocations of capital in each stock are shown by the figure below.

import matplotlib.pyplot as plt

xdata = np.arange(n)

width = 0.15

plt.figure(figsize=(8, 3.5))

plt.bar(xdata - 1.5*width, x_nom,

width=width, color='b', alpha=0.6, label='Nominal Distribution')

plt.bar(xdata - 0.5*width, x_box,

width=width, color='r', alpha=0.6, label='Box Uncertainty')

plt.bar(xdata + 0.5*width, x_ellip,

width=width, color='m', alpha=0.6, label='Ellipsoidal Uncertainty')

plt.bar(xdata + 1.5*width, x_kld,

width=width, color='g', alpha=0.6, label='KL Divergence')

plt.legend()

plt.ylabel('Fraction of Investment', fontsize=12)

plt.xticks(xdata, data.columns)

plt.show()

In this example, we show that data acquisition tools provided in the Python ecosystem (e.g., pandas-datareader) can be readily used to collect and feed real data into RSOME models. Apart from acquiring data, rich machine learning tools in the Python ecosystem can also be used to develop data-driven optimization models. More such examples will be provided in introducing the dro module for modeling distributionally robust optimization problems.

Reference

Zhu, Shushang, and Masao Fukushima. 2009. Worst-case conditional value-at-risk with application to robust portfolio management. Operations Research 57(5) 1155-1168.