| Star | Watch | Fork |

| Home |

|---|

| User Guide |

| Examples |

| About |

Joint Production-Inventory

In this example, we considered the robust production-inventory problem introduced in Ben-Tal et al. (2004). The formulation of the robust model is given below,

\[\begin{align} \min~&\max\limits_{\pmb{d}\in \mathcal{Z}}\sum\limits_{t=1}^{24}\sum\limits_{i=1}^3c_{it}p_{it}(\pmb{d}) &&\\ \text{s.t.}~&0 \leq p_{it}(\pmb{d}) \leq P_{it}, && i= 1, 2, 3; t = 1, 2, ..., 24 \\ &\sum\limits_{i=1}^{\top}p_{it}(\pmb{d}) \leq Q_i, && i = 1, 2, 3 \\ & v_{\min} \leq v_0 + \sum\limits_{\tau=1}^{t-1}\sum\limits_{i=1}^3p_{i\tau} - \sum\limits_{\tau=1}^{t-1}d_{\tau} \leq v_{\max}, && t = 1, 2, ..., 24, \end{align}\]with random variable \(d_t\) representing the uncertain product demand during the period \(t\), and the recourse decision variable \(p_{it}(\pmb{d})\) indicating the product order of the \(i\)th factory during the period \(t\), where \(i=1, 2, 3\), and \(t=1, 2, …, 24\). Parameters of the problem are:

- Production cost: \(c_{it} = \alpha_i\left(1+\frac{1}{2}\sin\left(\frac{\pi(t-1)}{12}\right)\right),~\text{where }\alpha_1 = 1, \alpha_2 = 1.5, \alpha_3 = 2 \)

- Nominal demand: \({d}_t^0 = 1000\left(1 + \frac{1}{2}\sin\left(\frac{\pi(t-1)}{12}\right)\right)\)

- The maximum production capacity of factory \(i\): \(P_{it} = 567\)

- The maximum total production capacity of the \(i\)th factory throughout all periods: \(Q_i = 13600\)

- The minimum allowed level of inventory at the warehouse: \(v_{\min}=500\)

- The maximum storage capacity of the warehouse: \(v_{\max}=2000\)

- The initial level of inventory: \(v_0=500\).

The code segment below imports RSOME and defines parameters mentioned above.

from rsome import ro

import numpy as np

T = 24

t = np.arange(1, T+1)

d0 = 1000 * (1 + 0.5*np.sin(np.pi*(t-1)/12))

alpha = np.array([1, 1.5, 2]).reshape((3, 1))

c = alpha * (1 + 0.5*np.sin(np.pi*(t-1)/12))

P = 567

Q = 13600

vmin = 500

vmax = 2000

v = 500

theta = 0.2

It is assumed that the random demand is within a box uncertainty set

\[\mathcal{Z}=\prod\limits_{t=1}^{24}[{d}_t^0 - \theta {d}_t^0, {d}_t^0 + \theta {d}_t^0].\]and in the adaptive robust optimization framework, the recourse decision \(\pmb{p}(\pmb{d})\) is approximated by the expression \(p_{it}(\pmb{d}) = p_{it}^0 + \sum_{\tau\in [t-1]}p_{it}^{\tau} d_{\tau}\), i.e., the affine decision rule \(p_{it}\in\mathcal{L}([t-1])\). The robust model can be then implemented by the code below.

model = ro.Model()

d = model.rvar(T)

uset = (d >= (1-theta)*d0, d <= (1+theta)*d0)

p = model.ldr((3, T)) # define p as affine decision rule

for t in range(1, T):

p[:, t].adapt(d[:t]) # adaptation of the decision rule

model.minmax((c*p).sum(), uset) # worst-case objective

model.st(0 <= p, p <= P)

model.st(p.sum(axis=1) <= Q)

for t in range(T):

model.st(v + p[:, :t+1].sum() - d[:t+1].sum() >= vmin)

model.st(v + p[:, :t+1].sum() - d[:t+1].sum() <= vmax)

model.solve()

Being solved by the default LP solver...

Solution status: 0

Running time: 1.0346s

The worst-case total cost is represented by the variable wc_cost, as shown below.

wc_cost = model.get()

wc_cost

44272.827493119396

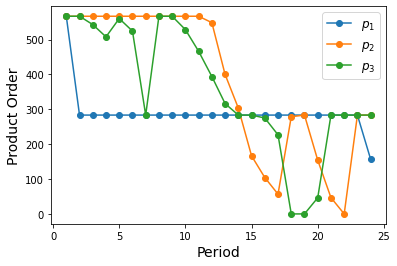

We may further investigate the decision rule \(p_{it}(\pmb{d})\) under given values of the random demand \(\pmb{d}\). For example, the code below visualizes the values of product orders under the nominal demand \(\pmb{d}_0\).

import matplotlib.pyplot as plt

p_nomial = p(d.assign(d0))

plt.plot(np.arange(1, T+1), p_nomial.T,

marker='o', label=[r'$p_1$', r'$p_2$', r'$p_3$'])

plt.legend(fontsize=12)

plt.xlabel('Period', fontsize=14)

plt.ylabel('Product Order', fontsize=14)

plt.show()

It is demonstrated in de Ruiter et al. (2016) that there could be multiple optimal solutions for this robust production-inventory problem. All of these optimal robust solutions have the same worst-case objective value, but the affine decision rule \(\pmb{p}(\pmb{d})\) could be greatly vary, leading to very different performance under non worst-case realizations. For example, if different solvers are used to solve the robust model above, solutions for \(\pmb{p}(\pmb{d})\) could be quite different.

Here we follow the steps introduced in de Ruiter et al. (2016) to find a Pareto robustly optimal solution: change the objective into minimizing the cost for the nominal demand trajectory. Furthermore, add a constraint that ensures that the worst-case costs do not exceed the worst-case cost found in the robust model above. Please note that the nominal objective can be equivalently written as the worst-case cost over an uncertainty set \(\mathcal{Z}_0=\left\{\pmb{d}^0\right\}\), i.e., enforcing \(\pmb{d}\) to be the same as the nominal trajectory. The code is given below to find the Pareto robustly optimal solution.

model = ro.Model()

d = model.rvar(T)

uset = (d >= (1-theta)*d0, d <= (1+theta)*d0) # budget of uncertainty

uset0 = (d == d0,) # nominal case uncertainty set

p = model.ldr((3, T))

for t in range(1, T):

p[:, t].adapt(d[:t])

model.minmax((c*p).sum(), uset0) # the nominal objective

model.st(((c*p).sum() <= wc_cost).forall(uset)) # the worst-case objective

model.st((0 <= p).forall(uset))

model.st((p <= P).forall(uset))

model.st((p.sum(axis=1) <= Q).forall(uset))

for t in range(T):

model.st((v + p[:, :t+1].sum() - d[:t+1].sum() >= vmin).forall(uset))

model.st((v + p[:, :t+1].sum() - d[:t+1].sum() <= vmax).forall(uset))

model.solve()

Being solved by the default LP solver...

Solution status: 0

Running time: 0.3694s

The objective value is the total production cost under the nominal demand trajectory.

nom_cost = model.get()

nom_cost

35076.73675839579

Please refer to Table 1 of de Ruiter et al. (2016) to verify the worst-case and nominal production costs.

Reference

Ben-Tal, Aharon, Alexander Goryashko, Elana Guslitzer, and Arkadi Nemirovski. 2004. Adjustable robust solutions of uncertain linear programs. Mathematical Programming 99(2) 351-376.

de Ruiter, Frans JCT, Ruud CM Brekelmans, and Dick den Hertog. 2016. The impact of the existence of multiple adjustable robust solutions. Mathematical Programming 160(1) 531-545.